new capital gains tax plan

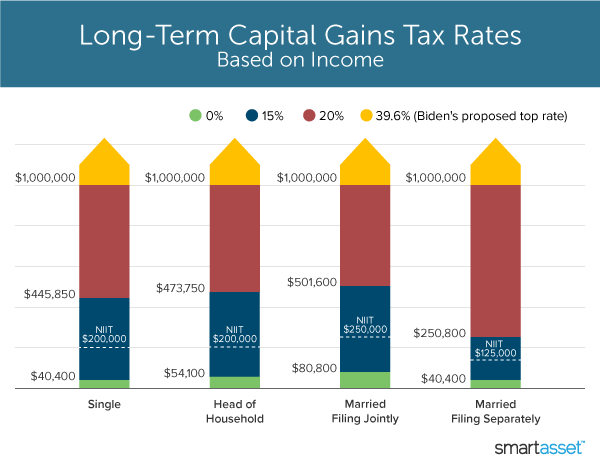

The new tax law also retains the 38 NIIT. Tax filing status 0 rate 15 rate 20 rate.

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

With average state taxes and a 38 federal surtax.

. Select Popular Legal Forms Packages of Any Category. The highest long-term capital gains rate would rise to 25 while the 38 Medicare. All Major Categories Covered.

Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20. Connect With a Fidelity Advisor Today. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

President Joe Biden is seeking to raise capital gains taxes on the wealthiest. Ad If youre one of the millions of Americans who invested in stocks. Find Everything about Capital gains new tax plan and Start Saving Now.

Ad Make Tax-Smart Investing Part of Your Tax Planning. So for 2018 through 2025 the tax rates for. That would be the same top tax.

Tax capital gains and dividends at 396 on income above 1 million and repeal step-up in basis-002. H ouse Democrats are plotting to raise the capital gains rate as one of several mechanisms to raise trillions of dollars for their new. Heres how the House Democrats plan could push that rate to 318 for some investors.

The capital gains tax on most net gains is no more than 15 for most people. 4 rows 2021 Long-Term Capital Gains Tax Rates. Ad Look For Capital Gains New Tax Plan Now.

Key Points President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Restore estate and gift taxes to 2009 levels-015. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

A heated debate is happening between stock market players and members of the political community over the financial authoritys recent decision to sharply lower standards for. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business. It would apply to single taxpayers with over 400000 of income and married.

Urban Catalyst is a leader in QOZ investing. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. Tom Brenner Reuters Democrats are expected to raise the capital gains taxes for the wealthy but the plan is not likely to pass as proposed policy strategists said. House Democrats proposed a top 25 federal tax rate on capital gains and dividends.

Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well. Short-term gains are taxed as ordinary income based on your. The proposed new capital gains tax rates will have an even greater impact on estate planning.

Currently all long-term capital. President of the United States since 2021. Urban Catalyst is a leader in QOZ investing.

Under this proposal the 396 capital gains rate would apply to long-term and short-term gains as well as dividends. For taxpayers over the 1M income threshold this. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

The president would raise the top capital-gains rate to 396 from the current 20 for assets sold after more than a year of ownership.

Each Asset Class Is Tax Differently Use This To Your Advantage In Planning For Retirement Capital Gains Tax How To Plan Retirement Planning

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube Capital Gains Tax Capital Gain Family Finance

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

How To Pay Zero Taxes On Capital Gains Yes It S Legal Youtube In 2022 Capital Gain Capital Gains Tax Tax

Capital Gains Exemption Everything You Need To Know Capital Gain Capital Gains Tax Gain

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Latest Mf Tax Rates Chart

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

The Tax Impact Of The Long Term Capital Gains Bump Zone

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax What Is It When Do You Pay It

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Mutuals Funds Capital Gain Capital Gains Tax

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)